Amortization schedule with fixed monthly payment and balloon

The former includes an interest-only period of payment and the latter has a large principal payment at. These are often 15- or 30-year fixed-rate mortgages which have a fixed amortization schedule but there are also adjustable-rate mortgages ARMs.

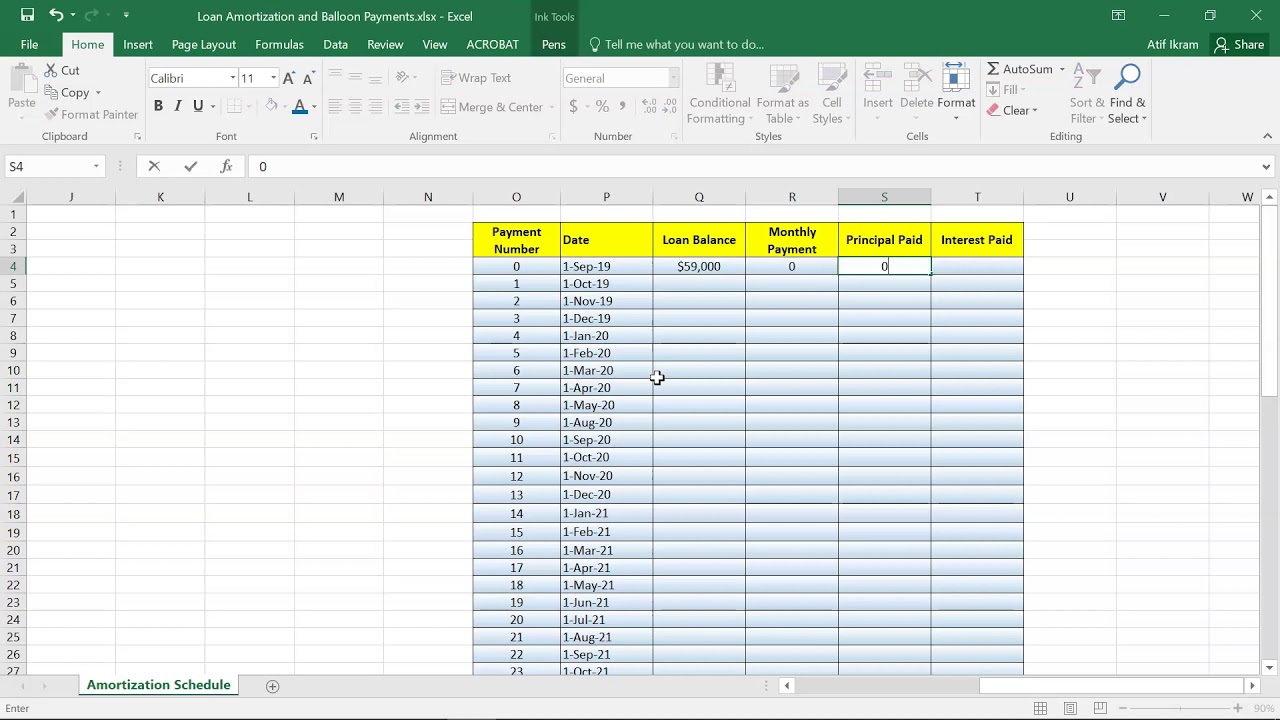

Loan Amortization And Balloon Payments Using Ms Excel Youtube

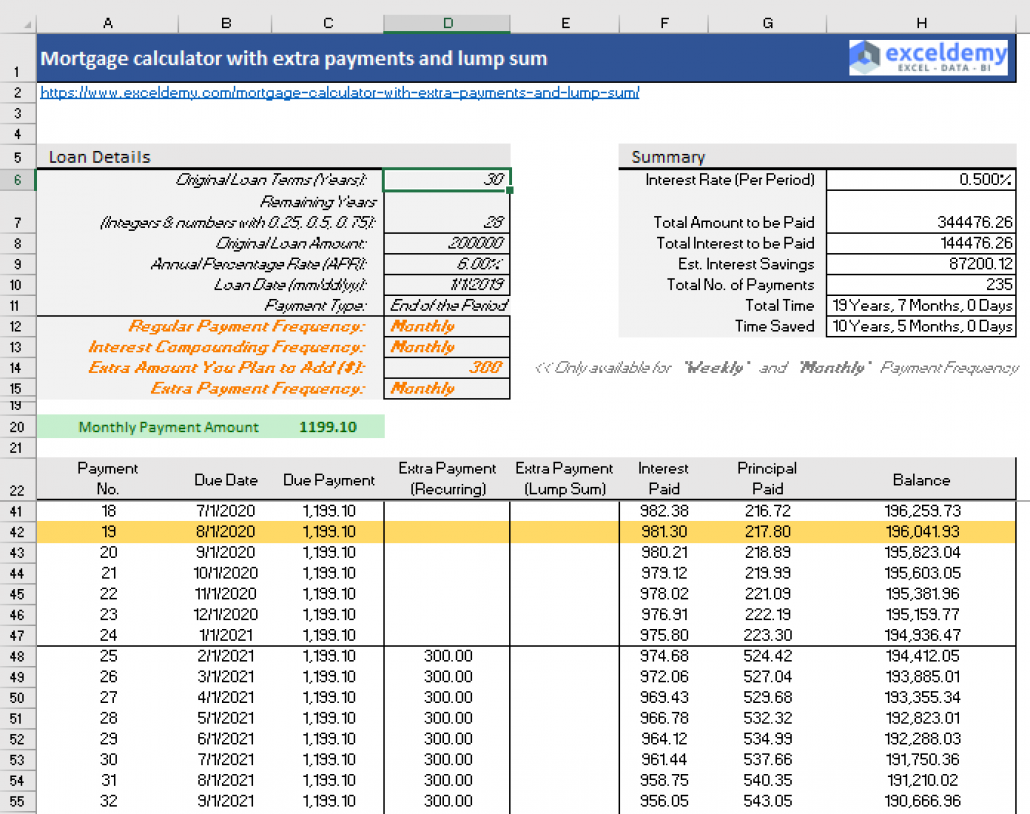

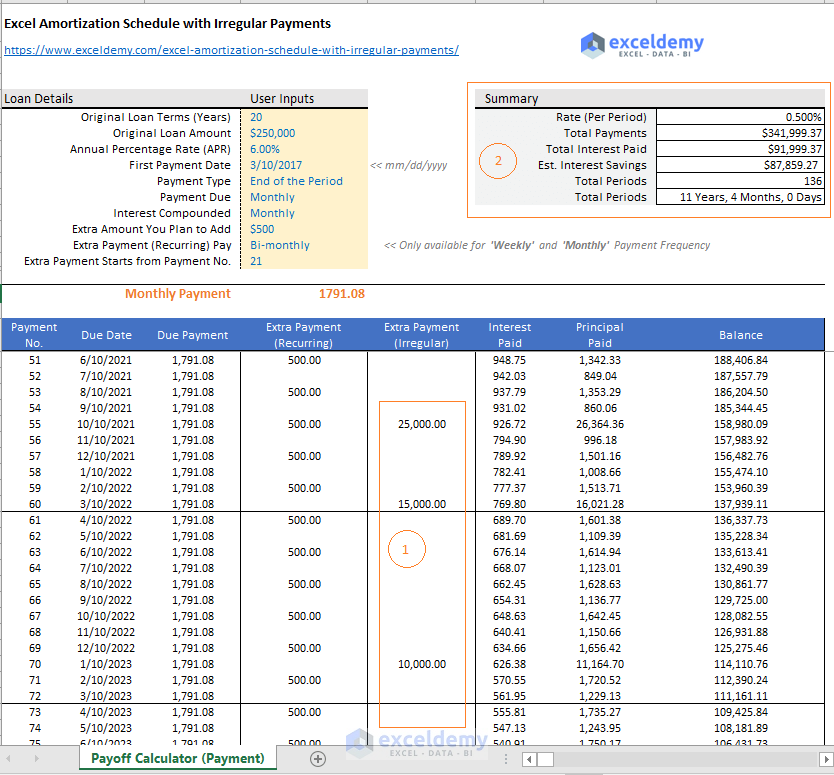

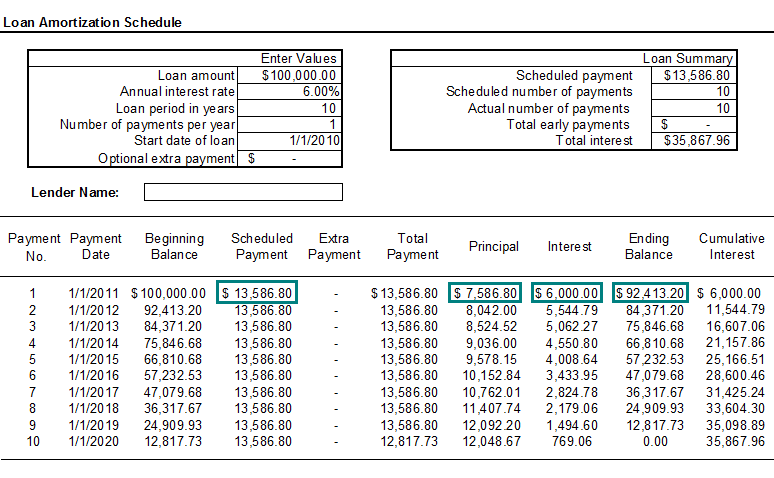

The amortization summary and interest saved.

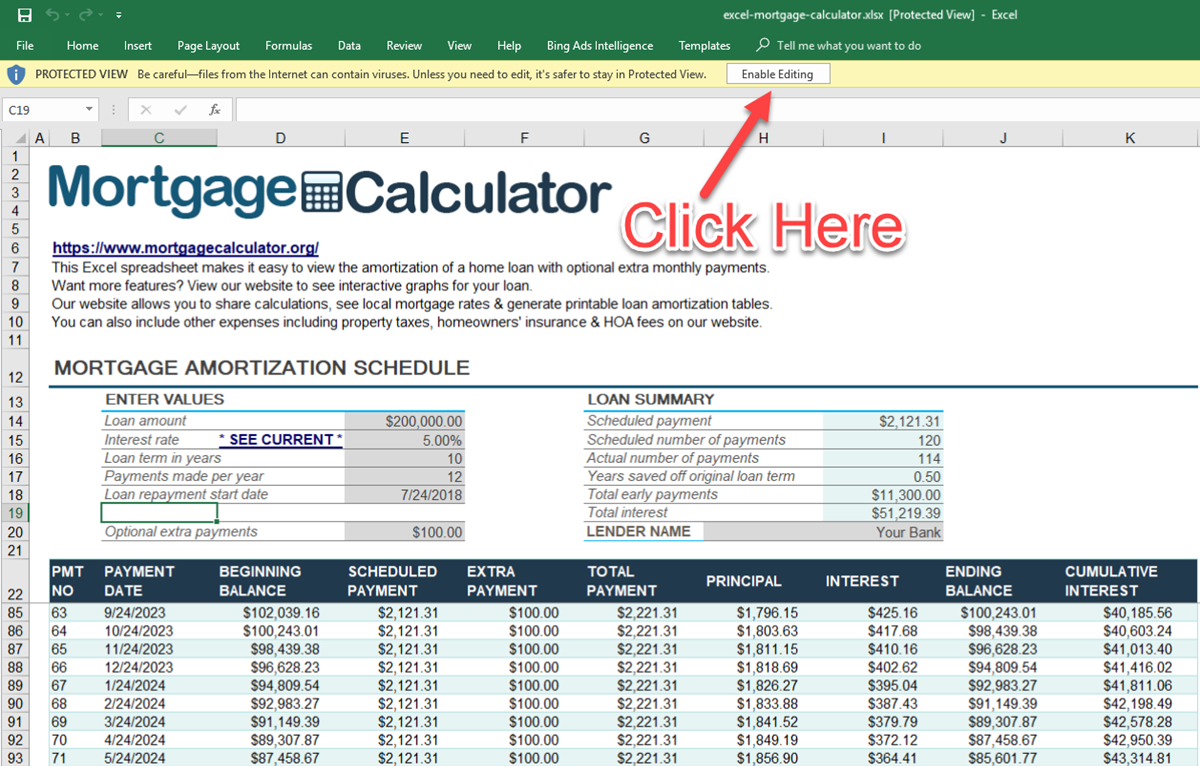

. Other common domestic loan periods include 10 15 20 years. It includes advanced features like amortization tables and the ability to calculate a loan including property taxes homeowners insurance property mortgage insurance. Types of Amortization Schedule.

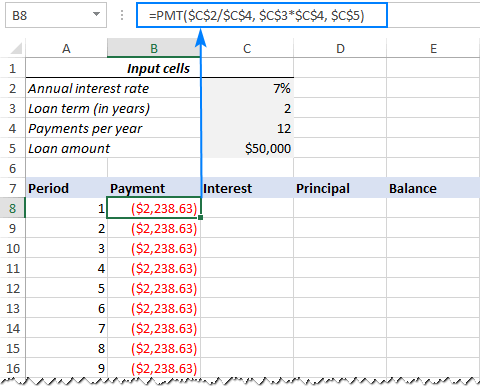

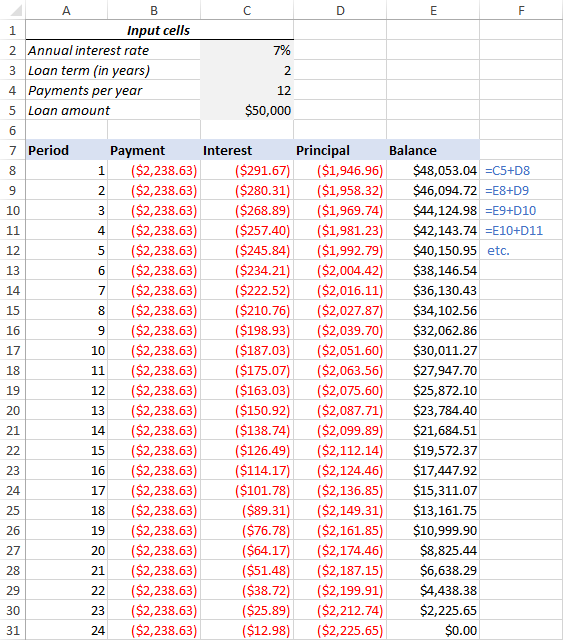

A portion of each installment covers interest and the remaining portion goes toward the loan principal. Now you can create the amortization schedule. How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule Extra Payments.

Payments are made on a monthly basis. Here are the types that you need to know. Optional extra payment - if you want to add an extra amount to.

Try out the free online monthly payment calculator today. A bullet repayment is a lump sum payment for the entirety of a loan amount paid at maturity. With ARMs the lender can adjust the rate on a predetermined schedule which would impact your amortization schedule.

Print a limited date range. Caps on rates and payments negative amortization payment options and recasting recalculating your loan. Export amortization schedules to Microsoft Excel and Word and to PDF CSV and XML with one-click.

Extra payments are not extra. Fixed principal payment calculator help. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments.

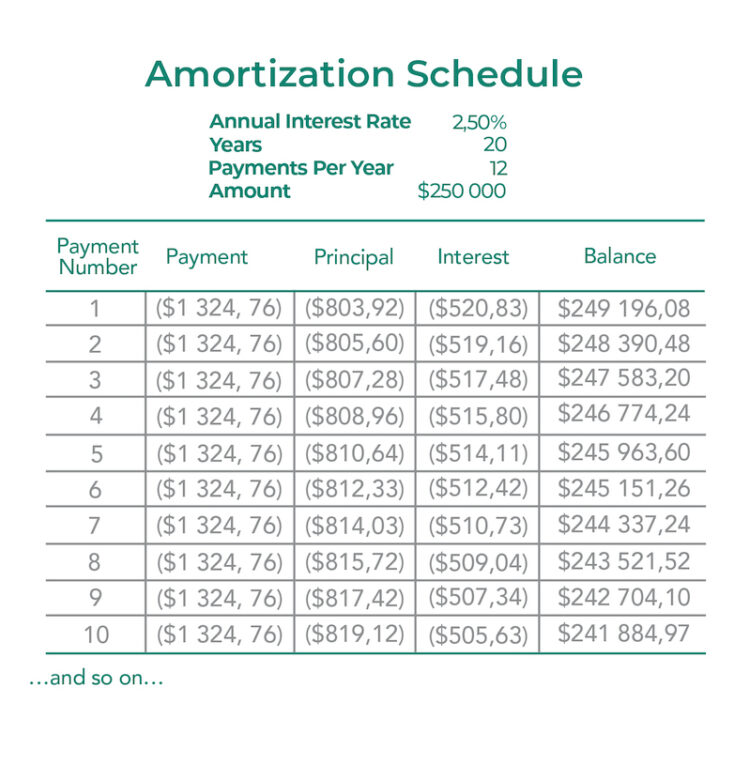

Amortization summary showing over 22000 in interest savings. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Consider a 30000 fully amortizing loan with a term of five years and a fixed interest rate of 6.

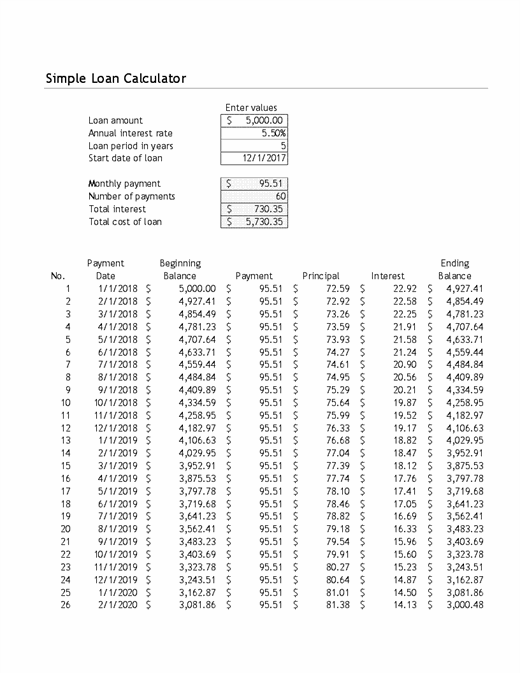

The loan is fully amortized with a fixed total payment of 57998 every month. Loan amortization is the process of scheduling out a fixed-rate loan into equal payments. Amortization Schedule is an amortization calculator used to calculate mortgage or loan payments and generates a printable amortization schedule with fixed monthly payment.

View totals at selected intervals by calendar or fiscal year-end. This spreadsheet lets you choose from a variety of payment frequencies including Annual Quarterly Semi-annual Bi-Monthly Monthly Bi-Weekly or Weekly Payments. The Monthly Payment Calculator will calculate the monthly payment for any loan if you enter in the total loan amount the number of months to pay off the loan and the loan annual interest rate.

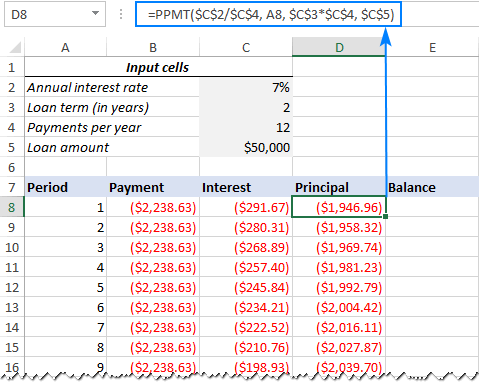

Principal Payment Monthly payment Interest payment 26337. You need to consider the maximum amount your monthly payment could increase. Also check out the Advanced Loan Payment Calculator for even more options.

It only works for fixed-rate loans and mortgages but it is very clean professional and accurate. This is the sum of all the payments you will make over the life of the loan. The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie.

This is the total amount you will pay per month not including property taxes or insurance. Add APR Truth-In-Lending disclosures. A note on terminology.

The amortization schedules summary header clearly shows you the amount of interest you will save by making extra payments. This amortization calculator returns monthly payment amounts as well as displays a schedule graph and pie chart breakdown of an amortized loan. A portion of each payment is for interest while the remaining amount is applied towards the.

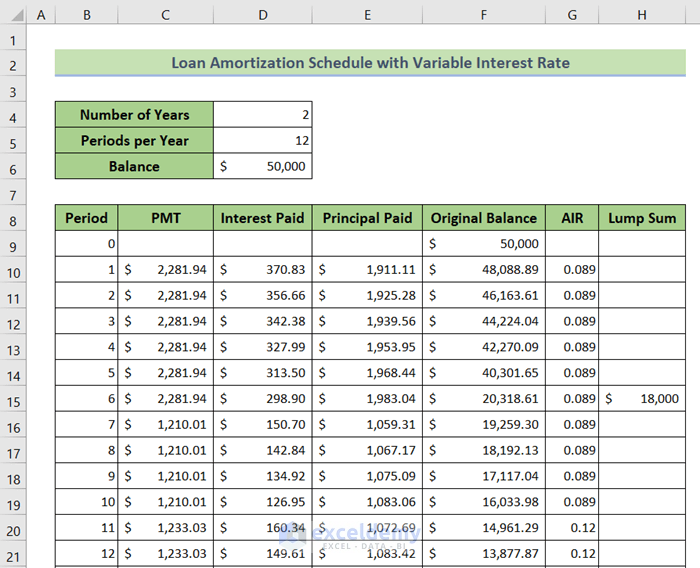

Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years. This tool allows you to calculate your monthly home loan payments using various loan terms interest rates and loan amounts. Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments.

Repeat this calculation for all 60 payments of the 5-year balloon loan. Mortgage rates popped sharply higher this week amid renewed concerns that the Fed will continue on its aggressive path. We will quickly return your payment amount total interest expense total amount repaid the equivalent interest-only payments to show how much you would end up spending on interest if you did not pay down the balance.

Simply enter the amount borrowed the loan term the stated APR how frequently you make payments. That is unlike a typical loan which has a level periodic payment amount the principal portion of the payment is the same payment to payment and the interest portion of the payment is less each period due to the declining principal balance. Example of Amortization Schedule.

Current Loan Balance Starting loan balance Principal payment. How to Calculate. Monthly weekly or daily.

Insert optional headers and footers. This is the total amount of interest you will pay over the life of the loan. A fixed principal payment loan has a declining payment amount.

Freddie Mac reported today that the average offered interest rate for a conforming 30-year fixed-rate mortgage increased forty-two basis points 042 jumping back up to 555 the highest such level since mid-July. Loans with bullet repayments are also referred to as balloon loans and are commonly. Examples of other loans that arent amortized include interest-only loans and balloon loans.

Depending on the type you can make payments accordingly on the basis of the compounding interest. Most people dont keep the same home loan for 15 or 30 years. Select any level of detail from summary to full schedule.

Amortization schedule showing 100 extra payments. You can use this online amortization schedule calculator to calculate monthly payments for any type of loans such as student loans personal loans car loans or home. Most importantly you need to know what might happen to your monthly mortgage payment in relation to your future ability to aff ord higher payments.

How Much Will My Monthly Mortgage Payments Be. The following table shows the amortization schedule for the first and last six months. The type of amortization schedule on excel depends on how frequently interest is compounded on the loan ie.

Consider this the cost to you of financing your car.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Amortization Schedule Definition Example Investinganswers

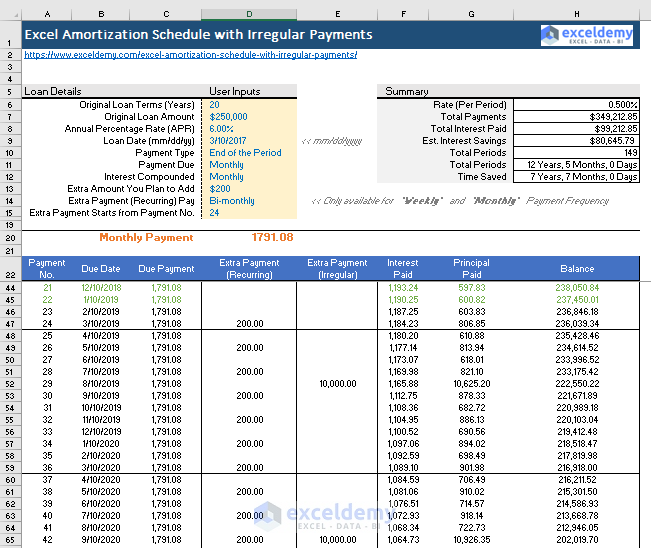

Excel Amortization Schedule With Irregular Payments Free Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Balloon Loan Calculator Single Or Multiple Extra Payments

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Amortization Schedule With Balloon Payment Using Excel To Get Your Finances On Track Udemy Blog

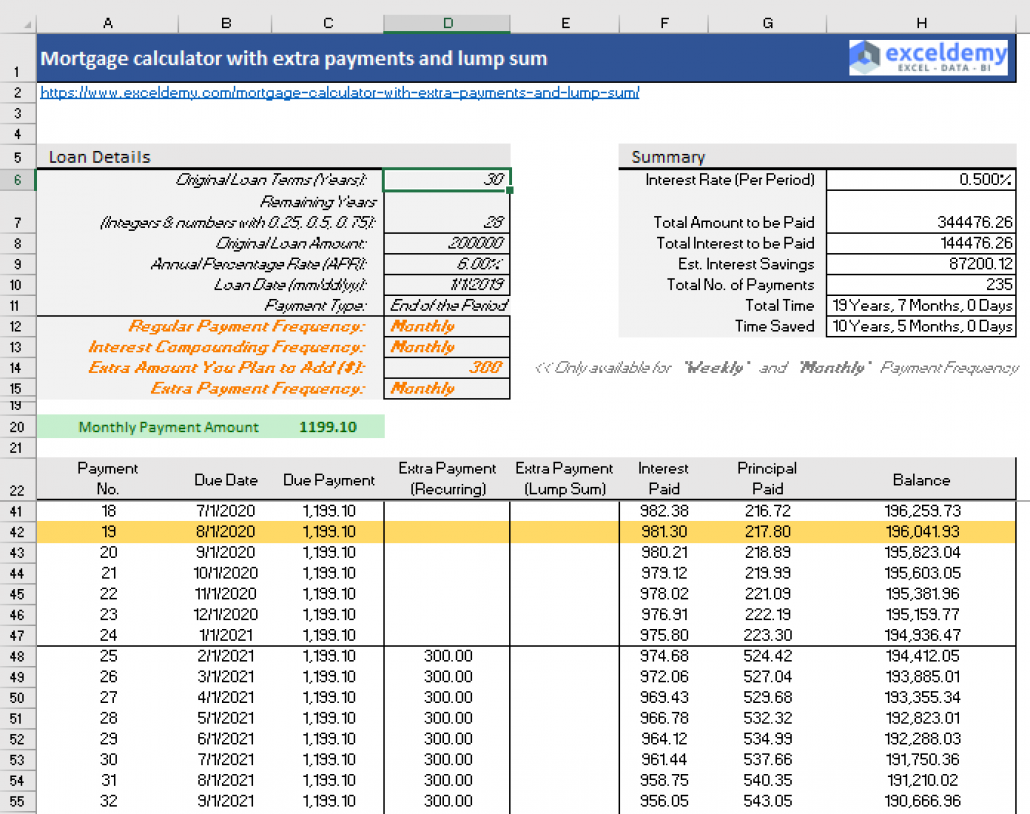

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Time Value Of Money Board Of Equalization

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Balloon Loan Calculator Single Or Multiple Extra Payments

Amortization Schedule With Balloon Payment Using Excel To Get Your Finances On Track Udemy Blog

Loan Amortization Schedule With Variable Interest Rate In Excel

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Excel Amortization Schedule With Irregular Payments Free Template

Easy To Use Amortization Schedule Excel Template Monday Com Blog